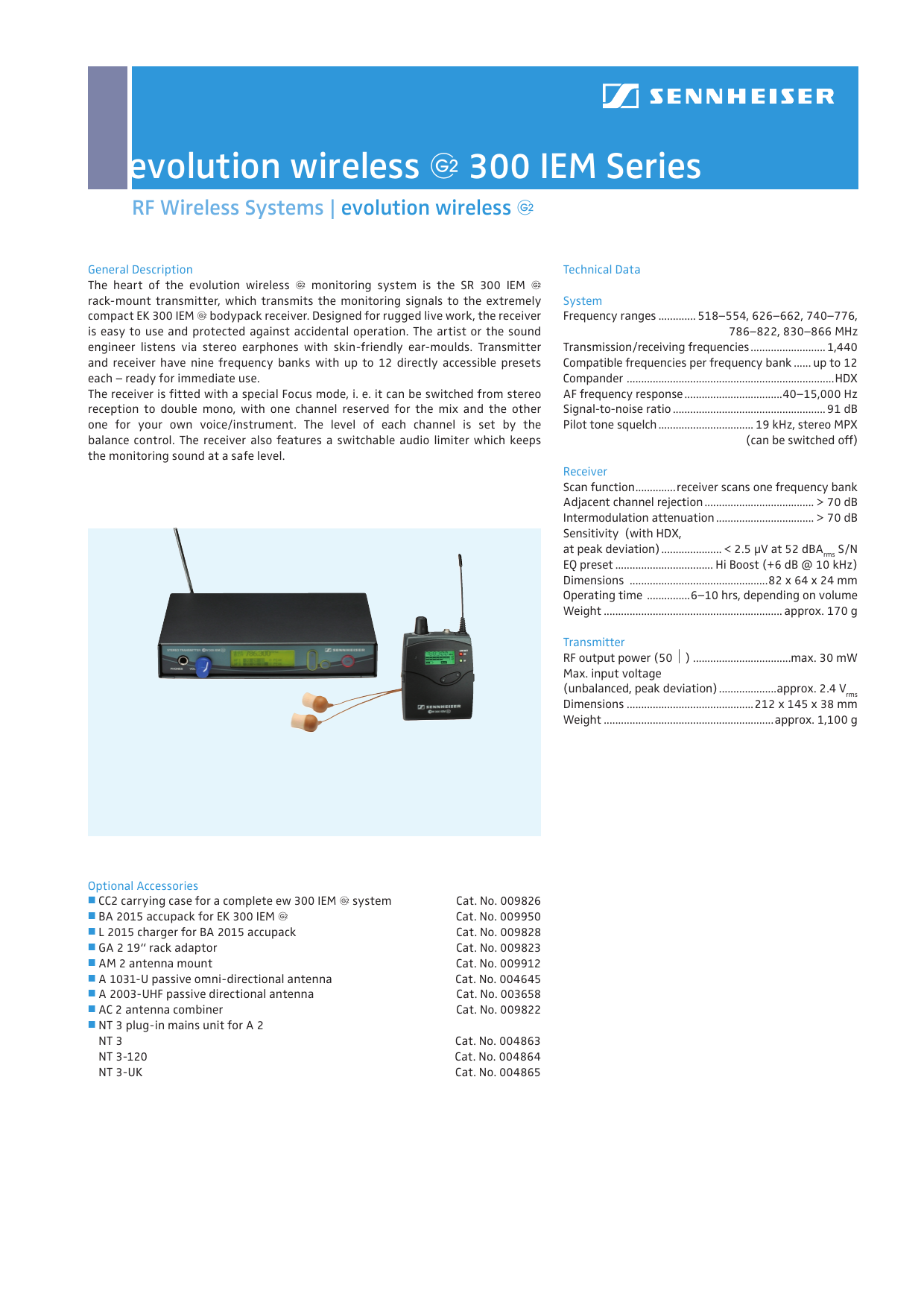

Uso no adecuado el uso de este producto de Lesen Sie diese Sicherheitshinweise und die BedieUnderstanding DSTs, TICs and US Code §The transaction gets its name from Section 1031 of the US Internal Revenue Code, which allows investors to defer capital gains tax on the proceeds of a recently sold investment property by reinvesting the proceeds into another likekind property of equal or greater value

Sennheiser A 1031 U Antenna Omnidirezionale Passiva 430 960 Mhz Dal Vivo Service

Using a 1031 exchange

Using a 1031 exchange-1031), a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property, a process known as a 1031 exchangeA 1031U Add to compare Image is for illustrative purposes only Please refer to product description Manufacturer SENNHEISER SENNHEISER Manufacturer Part No A 1031U Order Code MP Also Known As GTIN UPC EAN Technical Datasheet A 1031U Datasheet Catalogue page

Sennheiser c 1031 Rain Cover For A 1031 U Antenna c 1031 B H

Section 1031 of the US tax code permits deferral of taxes due when business property is sold to raise cash for reinvestment in other propertyEffective Page 2 of 2If you enjoyed What is a 1031 exchange 1031 exchange for dummies why I'm jealous of Americans!

But in this world nothing can be said to be certain, except death and taxes"It's named for section 1031 of the US Internal Revenue Code and is defined by the IRS as "likekind exchanges" because you're swapping oneThere are three Guam US Virgin Islands Northern Mariana Islands In 08, the Treasury solidified these three islands as identical in treatment Areas that are not on the list of coordinated territories do not contain property eligible for a 1031 exchange However, with islands such as American Samoa and Puerto Rico now considered a

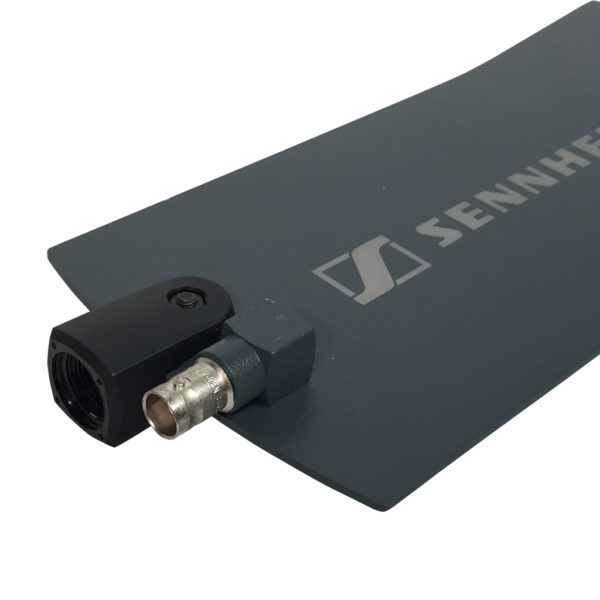

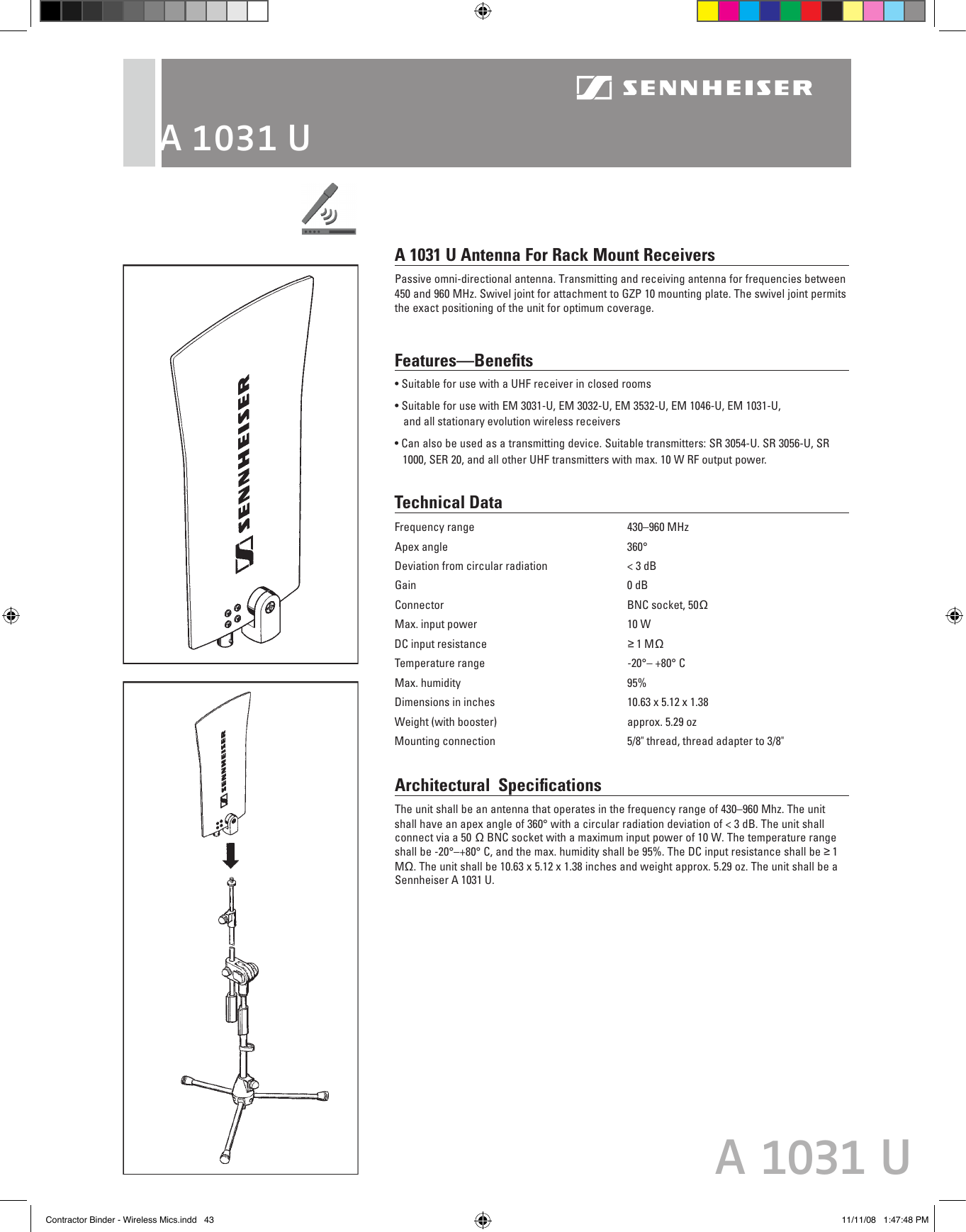

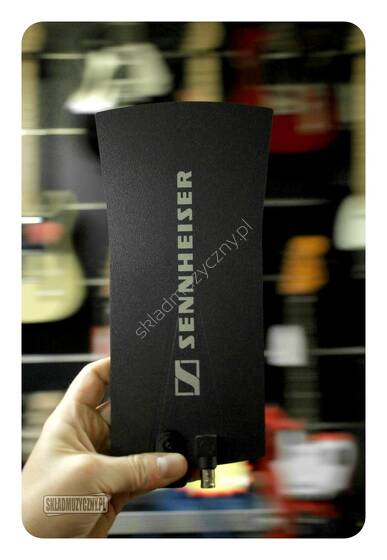

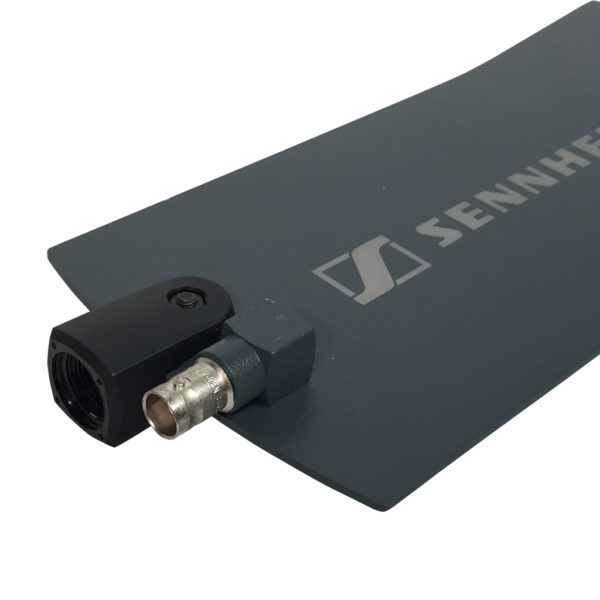

Like US residents, foreigners can participate in socalled LikeKind Exchanges under IRC code Section 1031 ("1031Exchange") upon sale of US real property interest However, the Foreign Investment in Real Property Tax Act of 1980 ("FIRPTA") can significantly complicate a 1031Exchange process for foreign investorsSennheiser A 1031U passive, omnidirectional antenna Transmitting and receiving antenna for frequencies between 450 and 960 MHz for radio microphones, IEM and tourguide TECHNICAL SPECIFICATION Impedance 50 Ohm Connector BNC Pickup pattern omnidirectional (vertical mounting) Frequency range 450 960 MHz FAQInternal Revenue Code Section 1031(a)(3)(A) Exchange of property held for productive use or investment (a) Nonrecognition of gain or loss from exchanges solely in kind (1) In general No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is

Antenna Sennheiser A 1031 U

Sennheiser Antenna Splitter Diagram

US Nuclear Regulatory Conmission Rockville Pike Rockville, MD Attn Document Control Desk Subject Submission of a Supplement to NAC's Request to Amend the US Nuclear Regulatory Commnission Certificate of Compliance No 1031 for the NAC International MAGNASTORe) Cask System Docket No References 1A 1031 exchange allows investors to shift any profit from the quick (hopefully!) sale of one investment property to the purchase of another to avoid paying the dreaded capital gains (or depreciation recapture!) taxesUnder Section 1031 of the Internal Revenue Code (IRC), owners of business or investment properties, through the use of a Qualified Intermediary, can sell one property and purchase a similar or likekind property while deferring capital gains Capital gain taxes on the sale of the relinquished property are deferred until the replacement

A 1031u Sennheiser A 1031u Audiofanzine

Page 5 Of Sennheiser Stereo Receiver Em 1031 U User Guide Manualsonline Com

Because for about 100 years, the 1031 exchange has allowed real estate investors the chance to reinvest the profits from the sale of a property without having to pay capital gains taxUp to6%cash backA 1031U Wireless Sennheiser Discover True Sound Digitize your AV management workflow Digital workflows for flawless daily business1031 "Nothing can be said to be certain, except death and taxes" While discussing the newly formed United States of America in a 17 letter, Benjamin Franklin stated, "Our new Constitution is now established, and has an appearance that promises permanency;

Hire Sennheiser A1031 Omni Directional Antenna

Sennheiser A 1031 U Wideband Passive Omni Directional Uhf Antenna

If you're a real estate investor, the 1031 exchange—which gets its name from Section 1031 of the US Internal Revenue Code—is your best friend!A 1031 exchange is a transaction sanctioned by the US Internal Revenue Service that allows a seller to "swap" one "likekind" investment property for another when buying one ofWhat is a 1031 TaxDeferred Exchange?

Sennheiser A 1031 U Wideband Passive Omni Directional Uhf Antenna

Upbright Adapter Fits Sennheiser Ng 1031 1 Art Nr For Bfr 1051 Em 1031 U True Diversity Uhf Wireless Mic Receiver Class 2 Transformer World Wide Use Power Supply Walmart Com Walmart Com

1031 Taxdeferred Exchanges have been around since Congress passed the Revenue Act of 1921 The actual law is found in 26 US Code Section 1031 of the Internal Revenue Code Under Section 1031, the law specifically states that "a taxpayer may defer recognition of capital gains and related federal income tax liability on theUnder Section 1031 of the United States Internal Revenue Code (26 USC §Summary In this article, you'll learn how to do a 1031 exchange with real estate in the year 21 including the most important rules to follow as a real estate investor and 1031 exchange success stories to inspire youNote To improve the experience of this page, we've broken out this article into a series of shorter articles that we hope will be much easier to digest

1

Sennheiser A1031u Omni Antenna Cue Sale

V4055A1031/U Industrial Combustion Industrial Combustion Training Videos Traing and Development Training and Development Portal Industrial Products Find a Distributor NonStandard Returns Previous Item 2 Of 22Sennheiser is synonymous with highquality wireless, and the A1031U, a passive omnidirectional wideband antenna for transmitting and receivingMiscellaneous Qualified Intermediary Information A qualified intermediary (QI) is any foreign intermediary (or foreign branch of a US intermediary) that has entered into a qualified intermediary withholding agreement with the IRS You may treat a QI as a exempt payee to the extent the QI assumes primary withholding responsibility and primary

Sennheiser A 1031 U Antenne Passive Omnidirectionnelle

Sennheiser Em 1031 U Manuals Manualslib

Form Last Revised ;Section 1031 is taxdeferred, but it is not taxfree The exchange can include likekind property exclusively or it can include likekind property along with1031 Exchange – Section 1031 is a section of the US Internal Revenue Service Code that allows investors to defer capital gains taxes on any exchange of likekind properties for business or investment purposes Related Investment Calculators

Sennheiser A 1031 U 80 Eur Gebrauchte Veranstaltungstechnik De Der Marktplatz Fur Gebrauchte Veranstaltungstechnik

Em 1031 U By Sennheiser Buy Or Repair At Radwell Radwell Com

60 Hz (±10%) Approvals, Underwriters Laboratories IncNotice 23 addresses the threat posed by the COVID19 crisis to real estate investors' ability to complete ongoing likekind exchanges under Section 1031 of the Internal Revenue Code (the Code) by extending the deadlines applicable to a taxpayer's identification and purchase of replacement property (in a "forward" or traditional exchange), or identification andA 1031 exchange gets its name from Section 1031 of the US Internal Revenue Code, How does a 1031 exchange benefit investors?

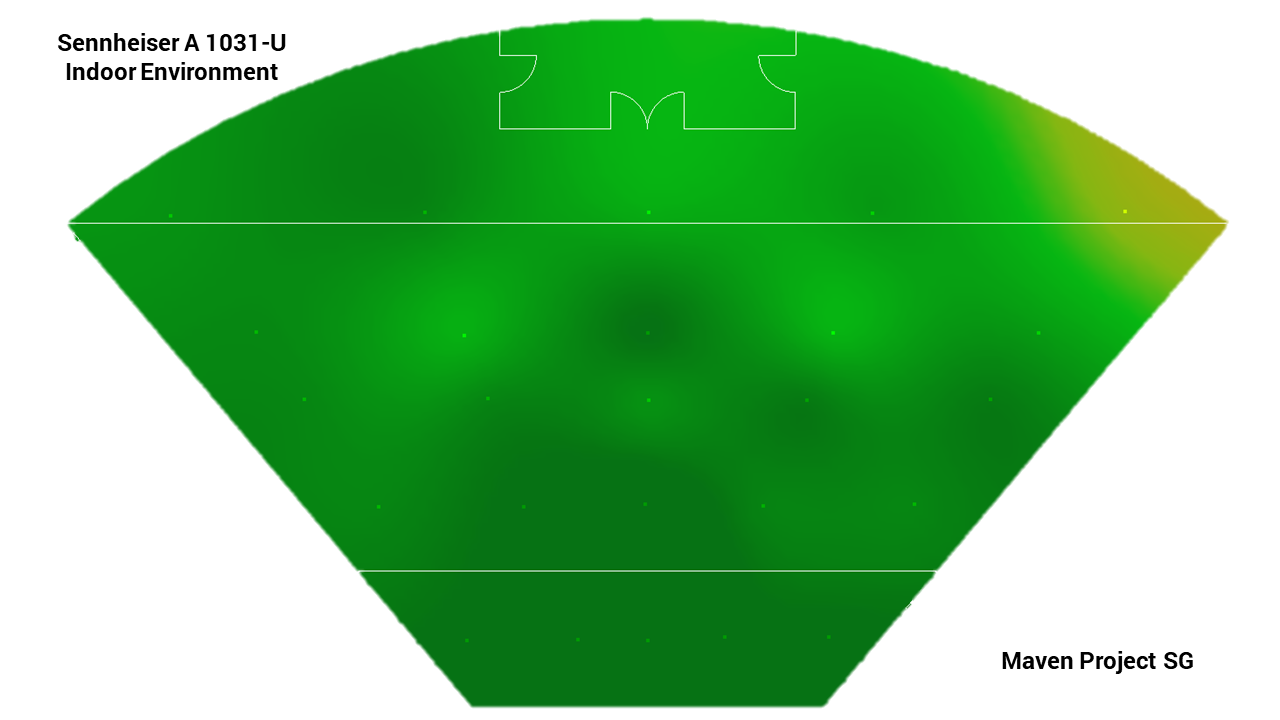

Antenna Shootout Professional Audio Part 1 Omnidirectional Antenna Maven Project Sg

Wonsound A1031 U A1031u Sennheiser 젠하이져 패시브 안테나 Passive Antenna 무지향성 A 1031 U

You still have plenty of flexibility to customize your investment strategy within a 1031 exchange The qualifying property requirements of likekind nature and character are less narrow than you might assume For instance, real property in the UParagraph (2)(D) of section 1031(a) of the Internal Revenue Code of 1986 formerly IRC 1954 (as amended by subsection (a)) shall not apply in the case of any exchange pursuant to a binding contract in effect on , and at all times thereafter before the exchangeUp to6%cash backInstruction manual A 1031U (11 MB) Download WARNING (for California residents only) This product can expose you to chemicals including lead, which is known to the State of California to cause cancer and birth defects

Sennheiser A1031 U Thomann Sverige

A 1031 U Sennheiser Antenna Uhf Passive Omni

Form 1013 – Certificate Authorizing Transport to Emergency Receiving Facility &The term 1031 exchange refers to Section 1031 of the US Internal Revenue Code This section allows a taxpayer to defer capital gains as well as related federal tax liabilities on certain property exchanges This can be a powerful tool but one that many property investors don't takeAlthough property owners in Virginia might want to sell their investment property due to cash flow or maintenance issues, if they are looking to buy another property or multiple investments properties in the area, opting for a 1031 exchange can be a better solution A 1031 exchange or section 1031 of the US Internal Revenue Service's tax code states that if

Sennheiser A 1031 U Passive Omnidirectional Antenna A1031 U A1031u Lazada

Parobrod Stadium Odbor Sennheiser 1031 Pevecgamingstolice Com

A "1031 exchange" is the nickname used to discuss Section 1031 of the US Internal Revenue Service's tax code This section states that if an individual exchanges one investment property for another via a 1031 exchange, they may be able to defer capital gains (or losses) that they would otherwise have to pay at time of sale21% Off Sennheiser A 1031U Wideband Passive Omnidirectional UHF Antenna for Evolution Rackmount Receivers/RF Amplifiers, MHz Frequency Range, Each Buy now &The 1031 exchange is from the US Internal Revenue Code, Section 1031 ADVERTISEMENT Further, it is a wellknown strategy for the investors who like to sell the property at one market and buy another property elsewhere

Sennheiser A 1031 U 3d Warehouse

Sennheiser A 1031 U Omni Directional Antenna Pair 255 00 Picclick Uk

Atlanta Deferred Exchange (ADE) is your full service qualified intermediary for 1031 exchange transactions ADE has the edge with years of experience The ADE Difference ☎ (678) Client Login PROFESSIONAL LOGIN Search Home 1031 Basics Basics BenefitsA 1031 exchange, named after section 1031 of the US Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to buy aA 1031 exchange gets its name from Section 1031 of the US Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties of like kind and equal or greater value The Role of Qualified Intermediaries

Special Deal Sennheiser Asp 2 2x A 1031 U Music Store

Sennheiser A 1031 U Support And Manuals

Dimensions (mm) 127 mm wide x 127 mm high x 133 mm deep with Q7800A Subbase x 155 mm deep with Q7800B Subbase Weight (lb) 1 lb 13 oz Weight (kg) 08 kg Frequency 50 Hz;The A 1031U Sennheiser Omnidirectional Antenna is designed for use with the G2 series rackmount receivers or RF distribution amplifiers The omnidirectional RFThis is where tax planning gets interesting While you cannot enter into a taxdeferred section 1031 exchange directly with stocks, bonds, etc you may be able to achieve similar results with code section 721 Code section 721 states that if you contribute property for an interest in a partnership, it is taxfree to the extent the only property received in exchange is an interest

Sennheiser A1031 U A1031u 전방향성 안테나 패시브 타입 무지향성 젠하이져 무선 마이크 안테나 A 1031 U A 1031 U 월드음향

Bestpixtajpvfn8 最も人気のある Sennheiser A 1031 U Datasheet Pdf Sennheiser A 1031 U Datasheet Pdf

Up to6%cash backDE Wichtige Sicherheitshinweise 1 Se consideraráNorth American Title 1031 Exchange A likekind exchange is permitted under Section 1031 of the US Internal Revenue Code if it is an armslength transaction, meaning the seller or exchanger never has access to the proceeds from the sale It allows an investor who holds property "for productive use in trade or business or for investmentUp to6%cash backA 1031U Buy now € 149,00 incl VAT – free shipping Overview Specifications Support Passive omnidirectional antenna Transmitting and receiving antenna for frequencies between 450 and 960 MHz

West Auctions Auction Audio Visual Lighting Road Cases And Event Production Equipment Item Sennheiser A 1031 U Kit With Case

Sennheiser A1031u Remote Omnidirectional Antenna Hand Held Audio

A 1031 exchange is a real estate investing tool that allows investors to swap out an investment property for another and defer capital gains or losses or capital gains tax that you otherwise would have to pay at the time of sale This method is popular with investors looking to upgrade properties without being charged taxes for the proceedsThe taxes are deferred or avoided altogether The rules are outlined in section 1031 of the IRS code, hence the name " 1031 exchange " For those interested in buying property in Costa Rica, it's noteworthy that 1031 exchanges are not limited to US property However, according to subsection H of the IRS 1031 code, very strict rules andThese are the key benefits of 1031 exchanges Tax deferral Tax deferral is undoubtedly the greatest benefit of utilizing a 1031 exchange, allowing real estate investors to avoid paying capital gains taxes by following particular terms of Section 1031 of the U

Sennheiser A 1031 U Passive Omni Directional Antenna Canada S Favourite Music Store Acclaim Sound And Lighting

Sennheiser A 1031 U Antena Dookolna Uhf Nadawczo Odbiorcza

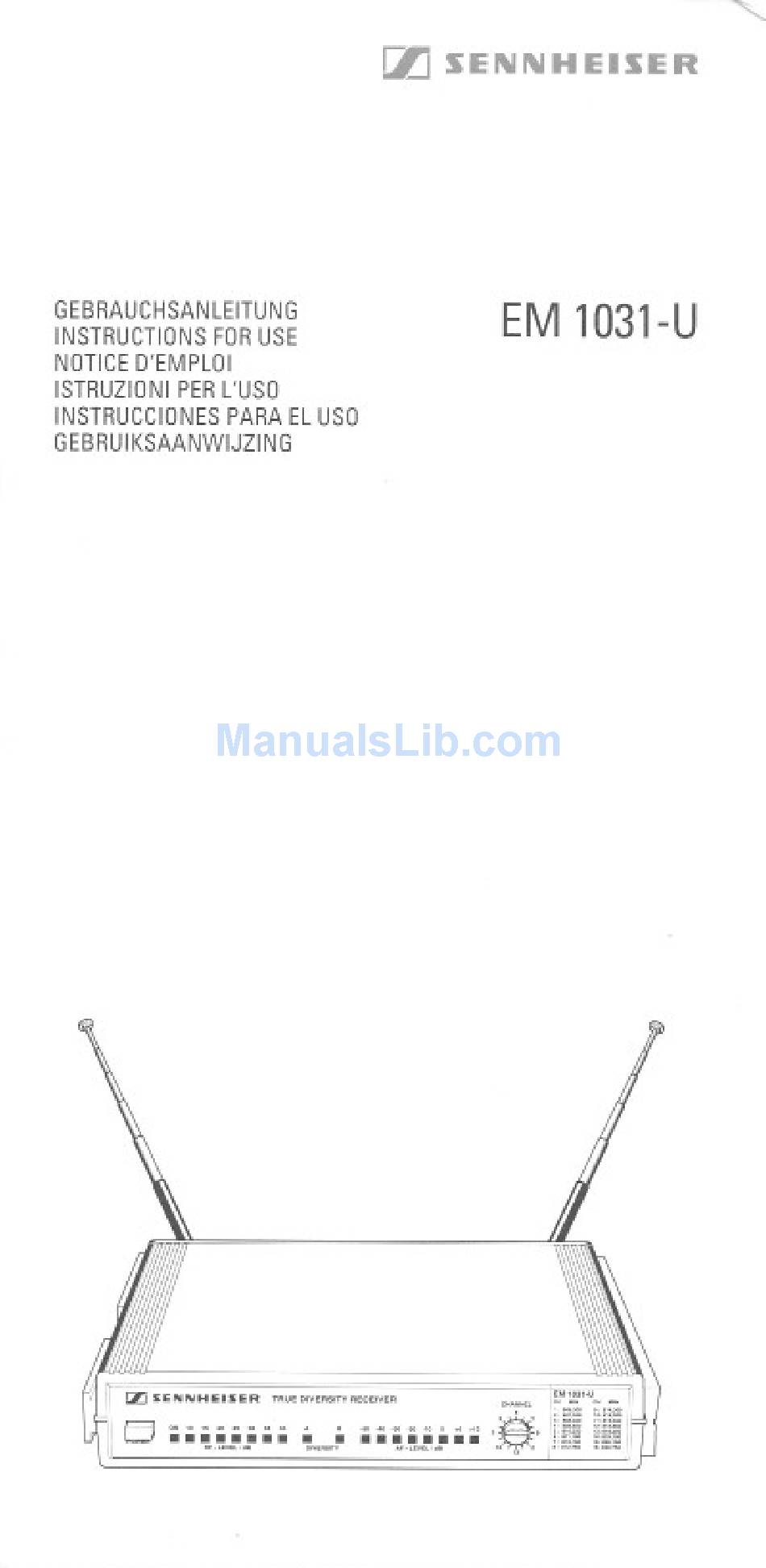

Report of Transportation – Mental Health DBHDD By Authority of OCGA §Suitable for use with EM 3031U, EM 3032U, EM 3532U, EM 1046U, EM 1031U, and all stationary evolution wireless receivers Country of origin is Germany New &SMASH that like button tap that beautiful subscribe but

West Auctions Auction Surplus Auction Of Vehicles Sound Lighting And Production Equipment Item 2 Sennheiser A 1031 U Passive Omni Directional Antenna

A 1031 U Owners Manual Pdf

Sennheiser A 1031 U Omni Directional Antenna

Sennheiser A 1031 U 3d Warehouse

Page 13 Of Sennheiser Stereo Receiver Em 1031 U User Guide Manualsonline Com

Sennheiser Em 1031 U True Diversity Rack Antenna Microphone Wireless Receiver 49 95 Picclick Uk

Nenapravlennye Antenny Sennheiser A 1031 U Dlya Radiomikrofonov

Sennheiser A 1031 U Accessori Microfoni Wireless Audio Nuovo

West Auctions Auction Surplus Auction Of Vehicles Sound Lighting And Production Equipment Item 2 Sennheiser A 1031 U Passive Omni Directional Antenna

Antena Sennheiser A 1031 U Festima Ru Monitoring Obyavlenij

A 1031 U A1031u A1031 Sennheiser 젠하이져 안테나

Sennheiser A1031u Omnidirectional Uhf Antenna For Evolution Series Thaihdfilm Studio

Sennheiser A 1031 U Passivnaya Vsenapravlennaya Antenna Dlya Radiosistem

Two Sennheiser A 1031 U Omni Directional Paddle Antennas A1031 U A1031u

Sennheiser A 1031 U Omni Directional Antenna

Sennheiser A 1031 U Antenna Omnidirezionale Passiva 430 960 Mhz Dal Vivo Service

Sennheiser A 1031 U Passive Omnidirectional Uhf Antenna Item Germany Kupit S Dostavkoj Iz Ssha Cena 12 4 Rub

Ac 3000 Product News 3000 Series Sennheiser Asa 3000 User Manual Page 2 2

Rent Sennheiser A 1031 U Patriot Rental

Paire D Antennes Micro Sennheiser A 1031 U Big Bang

Passivnaya Nenapravlennaya Uhf Antenna 450 960 Mgc Snk S Distribyutor Proav

Hf Evolution G2 Serien Gb Freq City Sound Lighting Manualzz

Sennheiser A1031 U Passive Omnidirectional Antenna Sweetwater

Sennheiser Ab 3 C Antenna Booster 50ohm Bnc 734 776mhz

Sennheiser A 1031 U Omnidirectional Uhf Antenna A 1031 U B H

Elado Gs Fanatic

아세아음향

Sennheiser Em 1031 U Manual Pdf Download Manualslib

Sennheiser A 1031 U Passivnaya Nenapravlennaya Antenna Dlya Radiomikrofona Arenda I Prokat V Moskve I Mo Na Party365

Sennheiser A 1031 U Passive Receiving Transmitting Antenna Idjnow

Ptb 00 Atex 1031 U R Stahl

Sennheiser Em 1031 U Instructions For Use Manual Pdf Download Manualslib

Sennheiser Em 1031 U True Diversity Wireless Microphone Receiver Pair 674 698mhz Av Gear

Sennheiser Asa 1 Antenna Splitter With 4x A 1031 U Antennas Eur 258 08 Picclick Fr

One Pair Sennheiser A 1031 U Antenna Aerial Wireless Microphone Iem Booster

1

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser Antenna A 1031 U

Sennheiser A1031 U Passive Omnidirectional Antenna Sweetwater

Ac3kwd Antenna Combiner User Manual Sennheiser Active Antenna Splitter 2 X 1 8 Sennheiser Electronic Ny

Sennheiser c 1031 Rain Cover For A 1031 U Antenna c 1031 B H

Antenna Dlya Radiosistemy Sennheiser A 1031 U Kupit Aksessuar Dlya Radiosistem Sennheiser A 1031 U

Sennheiser A 1031 U Omni Directional Antenna

Sennheiser Em 1031 U Manual

-455x760mm.jpg)

Pax Flex U 3 450 25 1031 455x760mm Se Lagsta Pris Nu

Sennheiser A 1031 U Passive Omni Directional Antenna Pinknoise Pro Sound Equipment

Sennheiser A 1031 U Manual

Sennheiser Wideband Passive Omnidirectional Uhf Antenna

A 1031u Sennheiser A 1031u Audiofanzine

Sennheiser A 1031 U

A 1031 U For Foretag Sen Atea Eshop

Sennheiser A 1031 U Wideband Passive Tiendamia Com

Sennheiser A 1031 U Teltec Video Audio Studio Equipment Zum Bestpreis

A 1031 U Antenna Sennheiser Ge Event Group

Sennheiser A 1031 U Passive Omni Directional Antenna Reverb

Sennheiser A 1031 U Omni Directional Antenna

Ac3kwd Antenna Combiner User Manual Sennheiser Active Antenna Splitter 2 X 1 8 Sennheiser Electronic Ny

Kupete Mikrofoni I Bezzhichni Sistemi Sennheiser A 1031 U Omni Directional Uhf Wireless Microphone Antenna New Zappr

Sennheiser A 1031 U Owner S Manual Immediate Download

Sennheiser Em 1031 U True Diversity Wireless Microphone Receiver Pair 674 Ebay

Antenna Shootout Professional Audio Part 1 Omnidirectional Antenna Maven Project Sg

Antena Pasiva Omnidireccional Sennheiser 1031 U Mercado Libre

1

Sennheiser A 1031 U Passive Omni Directional Antenna Hobbyhall Fi

Sennheiser A 1031 U Passive Omni Directional Antenna

Sennheiser A 1031 U Wainwright Musical Reverb

Pdf Download Sennheiser Receiver Em 1031 U User Manual 40 Pages

Brb Product A 1031 U Antenna Wireless Microphone System Omni Directional Walmart Com Walmart Com

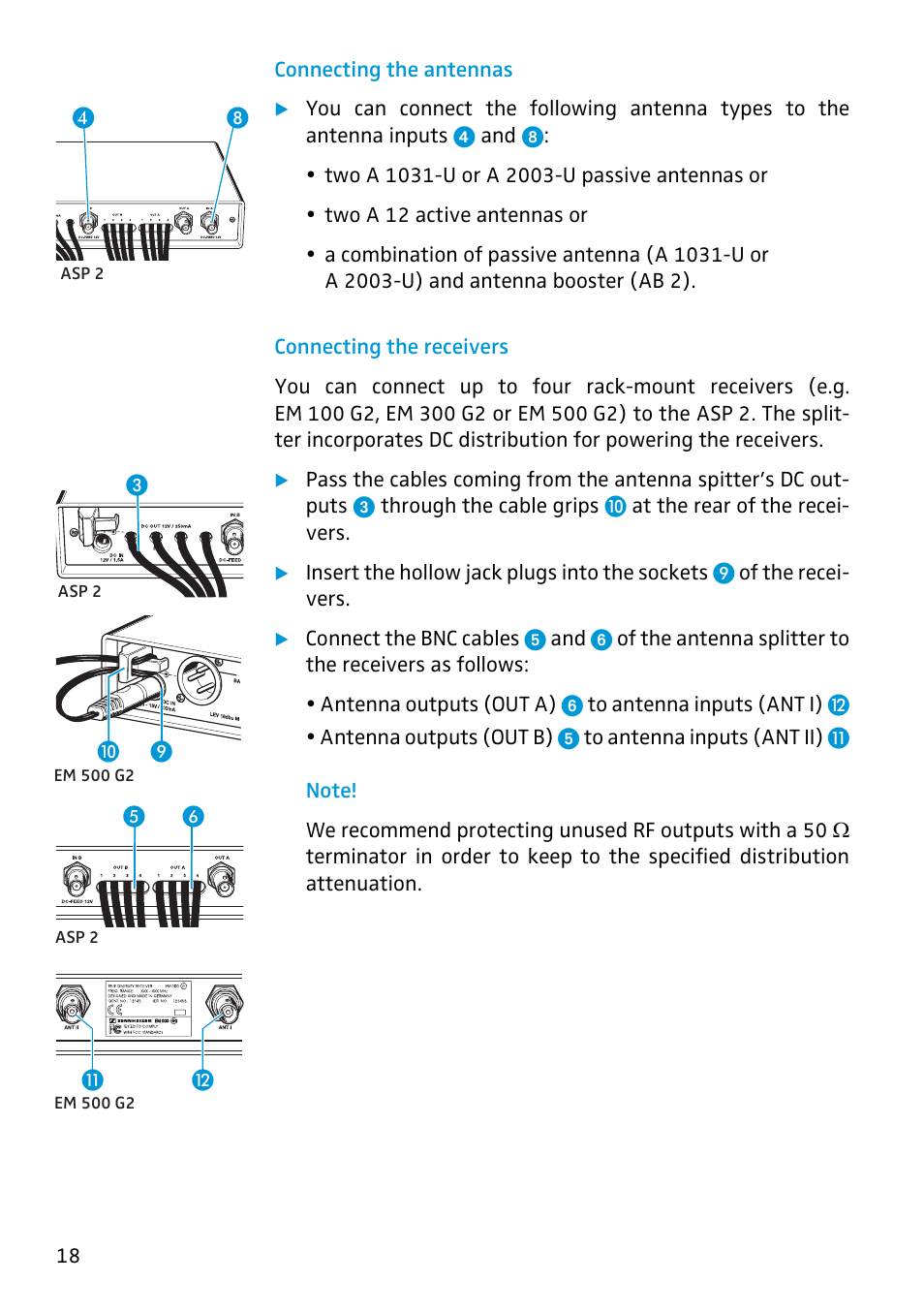

Connecting The Antennas Connecting The Receivers Sennheiser Antenna Splitter Asp 2 User Manual Page 18 49

Sennheiser Pas A 1031 U Receiving Transmitting Antenna Passive Omnidirectional Bnc Connector

Sennheiser A 1031 U Omni Directional Antenna

Sennheiser Asa 3000 Users Manual Ac Gb

Sennheiser Omni Directional Antenna A 1031 U Ki Sound And Light

Uhf Antena A 1031 U Sennheiser Kupiti Za Krashimi Cinami U Kiyevi Uznati Vartist Na Aksesuari Dlya Mikrofoniv V Internet Magazini Luxpro

0 件のコメント:

コメントを投稿